Robust employment knowledge might assist Fed flexibility

Posted by Noelle Corum, Affiliate Portfolio Supervisor on Jan eight, 2019, in Fastened Revenue

Expectations in regards to the path of US development have declined steadily within the previous few months.?Consensus forecasts go from very sturdy development, to severe doubts within the place development is headed, to recession fears.?However, the Federal Reserve has been unwavering in the views and rhetoric about coverage normalization, creating a poisonous mixture for markets.?At Invesco Fastened Revenue, our personal expectations of stable-to-weak development and tightening monetary circumstances had led us to a brief credit score, lengthy period view late final yr.

Nonetheless, sturdy employment knowledge launched on Jan. four will most likely offset a lot of the market’s fears of sharply declining development, in our opinion, and as much as date feedback by Fed Chair Jerome Powell have the symptoms of opened the doorway for that Fed to relent on its present trajectory. Because of these developments, our near-term development expectations have improved, and we anticipate barely simpler monetary circumstances within the first half of 2019, that is able to probably assist danger belongings.

?Robust December employment knowledge boosted development outlooks

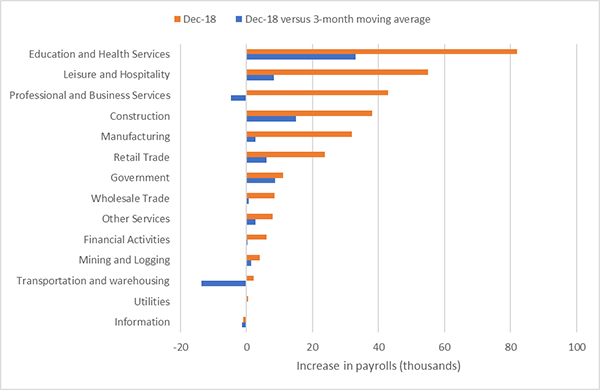

December payroll knowledge shocked considerably towards the upside. Complete nonfarm payrolls elevated by 312,000 jobs in December versus a consensus of 180,000, bringing the three-month development to round 254,000 and also the six-month development to round 222,000 jobs.1

Longer-term tendencies in payrolls are usually good predictors of gross home product development. The Jan. four employment report validates our view that there’s little evidence of a looming recession, and factors to strong development inside the first half of 2019. Whereas we want to stay away from placing an excessive amount of weight on one knowledge level, this payroll report provides towards the already optimistic shopper image . Uncertainties stay elevated for that other half from the yr, and we proceed to anticipate a slowdown in development following the affect of stimulative fiscal coverage wanes and also the Fed is constantly on the normalize coverage.

Determine 1: Month-to-month payrolls surged in December

Supply: US Bureau of Labor Statistics, Jan. four, 2019 .

December unemployment elevated, however, this was caused by an increase inside the labor power participation price, probably caused by stronger employment circumstances. Common hourly wages additionally shocked towards the upside, growing by zero.four% versus an anticipated zero.three%.1 Whereas these knowledge have been unstable prior to now, they’re based on our view that wage development is steadily accelerating and may probably entice the attention of coverage makers later this yr.

Implications for that Fed

Powell advised in his Jan. four remarks the Fed might take a extra cautious method on-going. In our view, Powell’s rhetoric didn’t shift as a lot as headlines advised, however he did seem to undertake a extra dovish stance. Whereas he remained upbeat around the economic system, he reiterated the Fed’s cautious stance going ahead. Particularly, he mentioned that the Fed could be individual in elevating rates of interest additional resulting from lackluster inflation knowledge which might be versatile if circumstances warrant. He additionally said that coverage flexibility applies to the Fed’s steadiness sheet; whereas Powell advised that latest market volatility is simply not because of the shrinking steadiness sheet, and asserted the discount will proceed for the time being, he acknowledged that the method might be altered, if want be.

Market response

Markets reacted to the developments with a risk-on tone in credit score and equities, and the US Treasury yield curve flattened. The US greenback strengthened in response to the payroll knowledge, solely to commerce weaker following Powell’s remarks. General, market reactions mirrored expectations of a extra cautious Fed on-going. Without having vital inflationary pressures, we think of the Fed has the pliability to be cautious.

Invesco Fastened Revenue outlook

Given our outlook for benign core shopper value inflation inside the near to time period, and little evidence of a possible breakout in inflation, we anticipate the Fed to maintain its cautionary tone via the primary quarter of 2019, without any price hike in March. A Fed “pause” towards a powerful development backdrop must be supportive of dangerous belongings, in our view. Nonetheless, we anticipate volatility to proceed as development knowledge moderates to decrease ranges.

A extra cautious Fed may probably result in a protracted development story and fewer likelihood of recession inside the near to time period. Nonetheless, this dynamic may additionally boost the chance of a probably extra aggressive Fed afterward inside the yr when wages are rising.

1 Supply: US Bls, as of Jan. four, 2019

Vital info

Period is a measure of the sensitivity from the worth of a collection revenue funding to a change in rates of interest. Period is expressed like a number of years.

Gross home product is a broad indicator of the area’s financial exercise, measuring the financial price of all the completed items and companies produced in that area on the specified time period.

The yield curve plots rates of interest, in a set time period limit, of bonds having equal credit score top quality however differing maturity dates to mission future rate of interest modifications and financial exercise. A set yield curve is a in which there’s little distinction inside the yields for short-term and long-term bonds of the identical credit rating top quality. Inside a standard yield curve, longer-term bonds possess a better yield.

Fastened revenue investments are topic to credit score danger from the issuer and the outcomes of fixing interest levels. Rate of interest danger means danger that bond costs typically fall as rates of interest rise and the other way around. An issuer may be not able to satisfy curiosity and/or principal funds, thereby inflicting its devices to lower in worth and lowering the issuer’s credit rating.

Noelle Corum, CFA

Affiliate Portfolio Supervisor

Invesco Fastened Revenue

Noelle Corum joined Invesco Fastened Revenue in August of 2010 and is concerned in derivatives, FX and charges exchanging, macro view implementation and asset allocation.

Ms. Corum started her funding skilled profession at Invesco following her undergraduate research.

She earned a BS diploma in enterprise administration, having a concentrate monetary evaluation, from Saint Louis College, the area she minored in arithmetic and earned a certificates in service management.