The way a Damaged Dishwasher Examined My Rewards Resolve

The difficulty began once the dishwasher stopped.

As somebody who thinks about bank cards for a dwelling so that as a interest , I see a silver lining in every home-maintenance catastrophe. Positive,?I’ll should spend a whole lot of ?to make?water cease popping out from the?ceiling in order to?get that rotating doohickey to rotate once more. However console myself?knowning that?in doing so, I’ll earn charge card rewards?from 2% to five%.?I’d save a lot more with a reduction by means of the cardboard issuer. The possibilities are limitless!

Generally, the will to squeeze each final bit of reward worth out of a transaction will get in the way by which of, you recognize,?getting issues carried out. It’s?nice to need the perfect deal attainable, however preoccupation?simply gets to be paralysis – and what occurs then? You find yourself doing dishes by hand for weeks whereas your damaged dishwasher mocks you using its lifeless LEDs.

Which card to utilize?

Homeownership?signifies that when something breaks, it’s on you to both repair it or change it out. Cope with sufficient DIY repairs and pay sufficient service techs to come back out and shrug at your nonfunctioning?no matter, as well as you’ll create a method of when you should trouble making an attempt to correct?one thing. This dishwasher?didn’t tickle my?fix-it bone,?so an alternative was so as.

Generally, the desire to squeeze each final little bit of reward worth out of a transaction will get in the manner in which of, you recognize, getting issues completed.

I’m lucky that I’ve just a little bit of cost savings for this sort of first-world emergency, so I?may?pay for?a fresh?dishwasher out of pocket. Placing it on a bank card, although,?allowed me to?earn rewards and made it and so i?didn’t have to truly purchase the factor till after it had been delivered.

Now for the massive query – which bank card?to utilize? The one which pays the most effective rewards price, proper?

Prior to now, I’d go to my card issuers’ bonus malls?and appeared for?an ideal deal. For one thing as an equipment, you may often discover a inexpensive or bonus rewards that amounted to five% to 10%. However?issuers have been closing their bonus malls in support of focused provides which might be tougher to include to your buying course of.?Employing a bonus mall is like going to a shopping mall: In the event you?go when, exactly the same retailers?in many cases are there whenever you?return. Utilizing focused offers is extra like sitting on a road nook whereas random retailers shout their provides?at you. All of it is determined by who’s shouting on that day.

Two competing provides

After trying by means of the provides out there on my small playing cards,?I discovered two that employed to my dishwasher downside. Observe that these provides had been particular?to my accounts – you would possibly see completely different provides:

On?my Chase Sapphire Most popular? Card:?”Earn 10% again in your Lowe’s buy, with a $12.00 again most! Supply legitimate once solely. Supply expires 12/19/2019 .”

On my Blue Money Most widely used? Card from American Categorical:?”Get a one-time $10 assertion credit rating by using your enrolled Card to invest a minimal of $75+ in many transactions in-store or on-line at choose house enchancment shops by 12/31/2019 .”

Appears easy sufficient: I’d get $12 again from Chase vs. $10 again from AmEx, so Chase it’s. I had been prepared to proceed to Lowe’s.

However wait.

Which bank card to make use of? One which pays the very best rewards price, proper? If solely it absolutely was that simple.

Taking a glance at these greenback figures, I neglected to suppose in share phrases. And relating to rewards, it is all about percentages. The dishwasher I wished got here to $735 after taxes and a haul-away charge?for that previous machine. Getting $10 or $12 again amounted to a reduction of 1.four%?or 1.6%. I carry another card – the Citi? Double Money Card – 18 month BT provide – that provides me 2% money again on all purchases . For a $735 buy, that involves $14.70.

So it’s settled! We’ll go along with Citi, and AmEx and Chase will go pound sand using their “provides.”

Reductions?plus rewards

Wait once more – I forgot one thing else.?On prime of the assertion credit score?from?every focused provide, I’d earn rewards on the acquisition itself. Observe how deep this rabbit gap goes? Oh, it will get deeper.

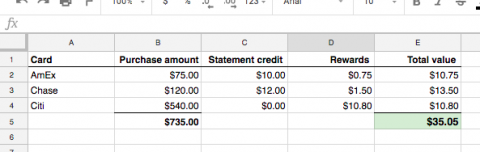

The Blue Money Most popular? Card from American Categorical would pay 1% money again on the acquisition. Phrases apply. The Chase Sapphire Most widely used? Card would pay 1 level per greenback; these 4 elements are price 1.25 cents apiece the way in which I redeem them. Now my rewards math appears to be like this:

Chase Sapphire Most widely used? Card:?$12 assertion credit score + $9.18 in rewards = $21.18.

Blue Money Most popular? Card from American Categorical:?$10 assertion credit rating + $7.35 in rewards = $17.35.

Each of these dunk around the $14.70 out there from the Citi card. So we’re again to Chase once more.?Getting $21.18 cost of worth on the $735 buy is a handful of 2.9% return. Fairly good!

However – what if I may do higher?

I ought to observe the following that my dishwasher died proper sooner than Thanksgiving, and?with Christmas bearing down, I had been nonetheless dithering, not as a result of I did not have the funds, however because of I’d grow to be so preoccupied?with Sticking It To?The Man that I was once afraid to drag the set off. I’d dithered so lengthy, the truth is, that the provide around the Chase Sapphire Most widely used? Card involved to run out.

And this is when my colleague Robin made a easy suggestion: “Cut up the acquisition between your playing cards. Internet an awesome $22.”

Whoa.

How a couple of Three-way split up?

I felt deep disgrace that I had not considered?this myself. I’ve split up purchases throughout handmade cards to?redeem rewards – I when purchased a treadmill with the collected?money again on 4 totally different playing cards. However had not carried out to maximise my upfront cost savings.

And since i have can’t go away effectively sufficient alone, I assumed: As a substitute of splitting the acquisition throughout?two handmade cards, why don’t you three? Why not quite simply sufficient on the AmEx and Chase playing cards to money within the provides, then place the remaining on the Citi card? I desired to?transfer every part?to some spreadsheet to get it straight, and if that isn’t a crimson flag –

I don’t suppose I have to state that that’s simply not regular habits. I’d pushed my whole worth to $35.05, or four.eight% from the dishwasher. This is a?fairly darn good return basically say so myself . Nevertheless the catch was that I nonetheless did not have a dishwasher. For the sake of stretching my financial savings from $14.70 to $35.05, I’d misplaced one other week to indecision and dishpan arms. It was insanity.

It was Dec. 17 and my?Chase provide was nearly kaput, so I placed on my hat and coat and visited Lowe’s. The time for speaking was over. Time for considering?was over. Let’s do this!

I needed to transfer every aspect to a spreadsheet to have it straight, and when that isn’t a crimson flag.

What have I grow to be?

As soon as within the retailer, I came across a pleasing affiliate who utilized some reductions and knocked the entire value as a result of $655.?We did the paperwork, and it came time for you to pay – and I couldn’t get it done.

Optimizing bank card rewards requires discovering your consolation degree. What lengths are you currently keen to go, how difficult are you currently keen to create issues in order to increase your financial savings?

I had all three handmade cards out, in a position to line ’em up and mow ’em down. However at this second, I?noticed myself since the?instrument I used to be .?There are individuals who unfold?issues out over three or 4 or 5 playing cards because of it’s the one approach they will afford what they want. And right here I’m, some bozo juggling playing cards for?a couple of bucks once the?good Lowe’s affiliate had already saved me $80.

So no, I did not?split up the acquisition?amongst three playing cards.

Judgment day

I?break up buying between?two playing cards! I put $200 on the AmEx and $455 on the Chase card for?an entire return of $29.69, or four.5%. I nonetheless can’t look myself within the mirror, however I’ve lengthy since painted total from the mirrors within my home anyway.

Optimizing charge card rewards requires discovering your consolation degree. What lengths are you currently keen to go? How difficult are you keen to make issues to maximise your cost savings?

It’s by pointing out placed you draw the street between having enjoyable gaming the machine and stressing your self out over nickels and dimes. I’d crossed my line, and that i didn’t prefer it.

Loads of folks might be completely cool with splitting this buy amongst three or extra playing cards and possibly even throwing inside the steadiness of the present card, too. It doesn’t matter a lot to the?individual on the register – having an extra card provides possibly Ten seconds to the transaction. In the event that they will allow you to do it, gladly do something.

It’s all about the place you draw the road between having enjoyable gaming the machine and stressing your self out over nickels and dimes. I’d crossed my line, and I didn’t prefer it.

?

I accustomed to clip coupons however needed to cease because of I used to be driving myself loopy. I’d purchase 24 rolls of toilet paper, then see a coupon for 25 cents off, and I’d get legitimately indignant. I’m no psycholologismist, however that does not sound wholesome.?Neither does spending weeks?treading water on the purchase order as a result of I’m nervous a couple of rounding error’s price of rewards.

I nonetheless don’t have my dishwasher. Because of I waited till so near Christmas,?supply?was going to have a month, nevertheless it’s coming. Till then, I’ll simply maintain washing and drying and hoping and praying.

And attempting to?overlook one thing I remembered whereas leaving Lowe’s.?Basically had simply used my Chase Freedom? to purchase the dishwasher at a division retailer whenever inside the final three months of 2019 , I might have gotten 5% money again in a single fell swoop. Dang it!