So why do LP&I corporations need to modernise their workforce-and why do they ought to begin now?

In my final weblog, I talked regarding the LP&I industry’s critical picture drawback and why that’s fuelling a expertise disaster. Wiped off as stale and uninspiring by most younger folks, LP&I corporations urgently need to reinvent themselves. The aim? Come to be the kind of enterprise that could entice and retain vivid expertise – in digital, along with in different areas like product sales, branding, marketing and advertising and authorized.

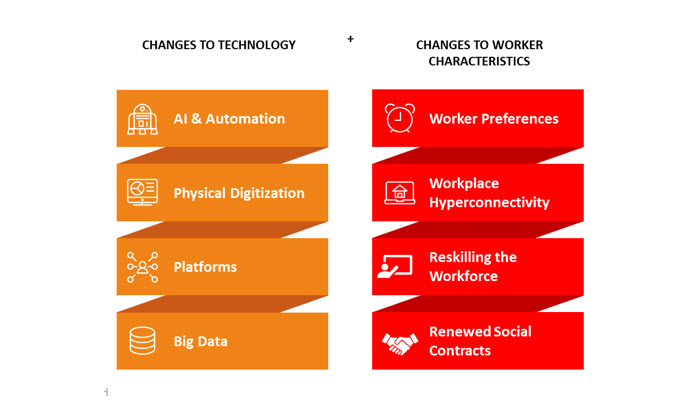

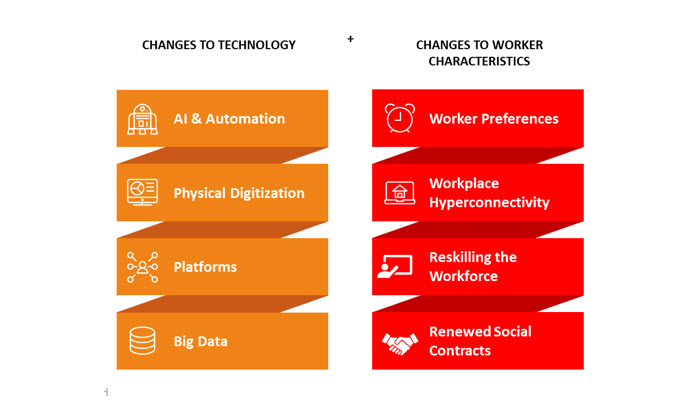

We’ve recognized a number of key cross-industry developments in every know-how and employee traits that showcase why modifications towards the workforce are inevitable:

Clearly, LP&I corporations have to act to satisfy the above mentioned developments and counter the ultimate PR drawback. In spite of everything, these destructive perceptions are deterring their future workforce (40% of corporations already are reporting expertise shortages). However there’s one other degree to all this: an injection of recent, new expertise will carry advantages that go far past simply sustaining headcount.

As industry turns into increasingly more digitalised, it looks like like the way forward for LP&I’ll lie elsewhere than in instantly suggested gross sales (or hiring IFAs). Assuming that’s the case, LP&I corporations have to reposition themselves and pivot to some completely new, extra related mannequin.

First, they ought to ship trendy merchandise. To focus on an increasingly more tech-savvy buyer base, they’ll have to modernise their choices. Normally they’ll shortly lose relevance. And there is no scarcity of opponents trying to seize a slice from the market.

Take a look at the insurtech startups which are penetrating with growing frequency. Free from any legacy constraints, they provide insight-driven options which allow them to entry and construct up an economic institution of buyer information that finally creates a a lot better person expertise.

As I produced in my earlier weblog, absolutely free themes of the long run have advanced wants and expectations that differ wildly from their predecessors. To retain (or win) the enterprise of those fickle consumers, who’ll fortunately bounce ship in the event that they feel their pursuits are higher served elsewhere, corporations need to know their expectations. Solely then can they have the ability to present manufactured goods acknowledge their deviation from the normal finance lifecycle mannequin (couldn’t get married, might have kids later in life, and so on).

Subsequent, to build up the capabilities that allow this amount of buyer understanding at scale, corporations want to make sure they’re attracting all sorts of expertise and expertise. Particularly, what this means is extra tech-savvy and future-thinking workers who can advise on the elements that affect product preferences – in addition to bringing the digital know-how desired to develop these merchandise.

That’s not all. Hiring folks with expertise in areas like analytics and knowledge science will enable LP&I corporations to acquire larger perception into their clients’ product preferences, attitudes to threat and additional. This might lead to extra correct buyer understanding (as a substitute of solely broad segmentation) and create the ability to tailor and goal product choices accordingly.

This expertise hole urgently should be bridged. Proper now, 33% of UK insurers declare a scarcity of assets with acceptable skillsets prevents them from adopting new systems to facilitate extra user-friendly customer support.

Moreover, because they provide the impression to be to the long run, LP&I corporations need to develop their definition of ‘expertise’ to incorporate automation and AI. As proven within the diagram above, these systems is one ingredient that’s already remodeling how jobs are finished, and that is solely the beginning: by 2030, 47% of jobs worldwide may be changed by AI. This may remodel the workforce, relieving workers of monotonous duties and providing them with the freedom to focus on extra advanced and rewarding assignments. Importantly, automation and AI shouldn’t be seen as changing the workforce. As an alternative, it ought to co-exist, complement and improve exactly what the workforce can obtain. Administration must put devoted effort into workforce optimization and re-skilling, by way of ‘on the go’ studying, to make sure most worth has been obtained.

Modernising with new vivid expertise additionally means LP&I corporations will profit from a extra versatile and future-looking workforce. This is a should have. With workplace rents rising inexorably, many corporations have develop into extra available to distant working and therefore are investing in systems that permit hyper-connectivity to make sure data is all the time obtainable. This empowers workers to dictate their very own schedules.

These organisations recognise the worth that flows from accommodating employee preferences on when and the place they work – by means of decrease prices (much less workers turnover) and improved workers loyalty. And there is little doubt this development is around the upswing: in latest surveys, 34% of enterprise leaders stated they anticipate more than half their workforce to become working remotely by 2020; 25% anticipate 75% of the UK workforce to be working remotely at that time.

Modernising with new expertise brings inside attain all the advantages I’ve recognized. In my subsequent weblog, I’ll check out the sensible steps illustrated beneath (reimagining the work, workforce and enablers) that LP&I corporations can take now to begin allowing the workforce from the long term.

In the meantime, I’m fascinated as always to listen to your ideas, so please electronic mail me or disappear a remark beneath. Thank you for studying.