Freddie Mac : Mortgage survey rates edge up to start 2019

Average fixed home loan rates started the year slightly greater than they ended 2019, based on the latest mortgage survey from Freddie Mac.

News Facts

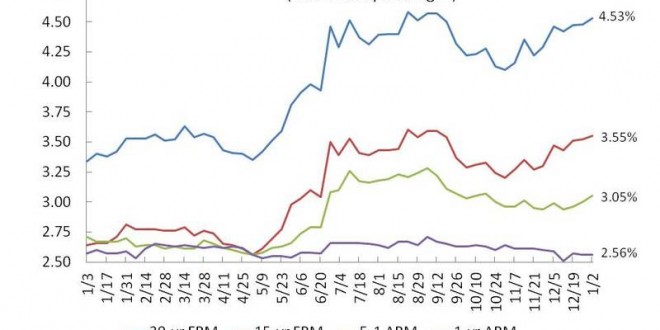

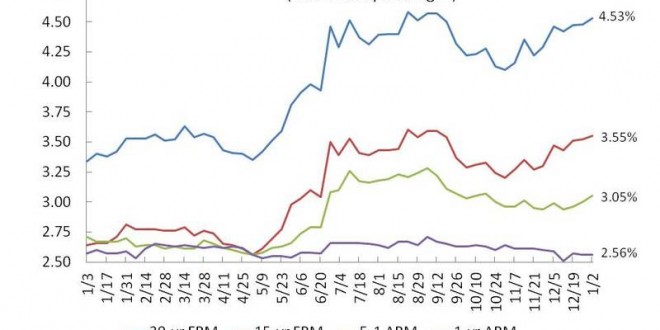

30-year fixed-rate mortgage (FRM) averaged 4.53 percent by having an average 0.8 point for that week ending January 2, 2019, up from a week ago if this averaged 4.48 percent. Last year at the moment, the 30-year FRM averaged 3.34 percent.

15-year FRM now averaged 3.55 percent by having an average 0.7 point, up from last week when it averaged 3.52 percent. A year ago at the moment, the 15-year FRM averaged 2.64 percent.

5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.05 percent this week by having an average 0.4 point, up from last week when it averaged 3.00 percent. Last year, the 5-year ARM averaged 2.71 percent.

1-year Treasury-indexed ARM averaged 2.56 percent this week by having an average 0.5 point, unchanged from last week. At the moment last year, the 1-year ARM averaged 2.57 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront price of acquiring the mortgage. Visit the following links for the Regional and National Type of loan Details and Definitions. Borrowers can always pay closing costs which aren’t contained in the survey.